What does it mean to be a highly compensated employee (HCE)? It depends because being an HCE means different things to different people and entities.

To you:

You worked hard throughout your career to move up the corporate ladder. You now earn a higher salary because of your skills, your contributions to the company’s success, and your overall expertise.

To your employer:

Your talents and contributions are appreciated — enough to merit a larger salary to keep you on the team.

You (and possibly your household) are treated as fellow owners of more than 5% of the company.

To the Internal Revenue Service (IRS):

As usual, the IRS creates definitions and rules around anything financial. Here’s the IRS’ definition of a Highly Compensated Employee (HCE):

“An individual who:

• Owned more than 5% of the interest in the business at any time during the year or the preceding year, regardless of how much compensation that person earned or received, or

• For the preceding year, received compensation from the business of more than $125,000 (if the preceding year is 2019, 130,000 if the preceding year is 2020 or 2021 and $135,000 if the preceding is 2022), and, if the employer so chooses, was in the top 20% of employees when ranked by compensation.”

Note: There is a wrinkle to the 5% ownership rule. If you plus a direct family member work for and own more than 5%, you’re considered an HCE. The definition of a family member includes your spouse, kids, and grandchildren.

Why Does This Matter?

The IRS cares about keeping track of HCEs because they want to ensure that tax-qualified employer benefits are beneficial to all employees. They also try to avoid skewing disproportionately to benefit highly compensated employees. If you meet the criteria for being an HCE, your employer then will mark you as an HCE, and this may limit the amount that you can contribute to your 401(k).

The tax benefits of a 401(k) are so beneficial for long-term wealth creation that the IRS wants to make sure all employees at all income levels can use these benefits. Each traditional 401(k) plan needs to pass certain tests each year to ensure that the plans aren’t becoming too “top-heavy” by benefitting the HCEs, owners, and other key employees.

What’s the Limit?

This HCE label isn’t intended to be a “feather in your cap.” Instead, it’s a way to measure participation rates for pre-tax 401(k)s. This becomes relevant when doing non-discrimination testing. These formulas and metrics can get complex, and it’s your employer’s responsibility to keep track of them when they manage a traditional 401(k) on behalf of their employees.

For 2022, the 401(k) contribution limit for an employee is $20,500 (plus $6,500 if you’re 50 or older). However, for an HCE, the total contribution amount generally can’t be more than 2% beyond the total amount that non-HCE employees contribute. When these non-discrimination tests are failed, the amounts above the 2% threshold are usually returned to the HCE, thus becoming taxable income for the HCE.

What You Can Do as An Employee

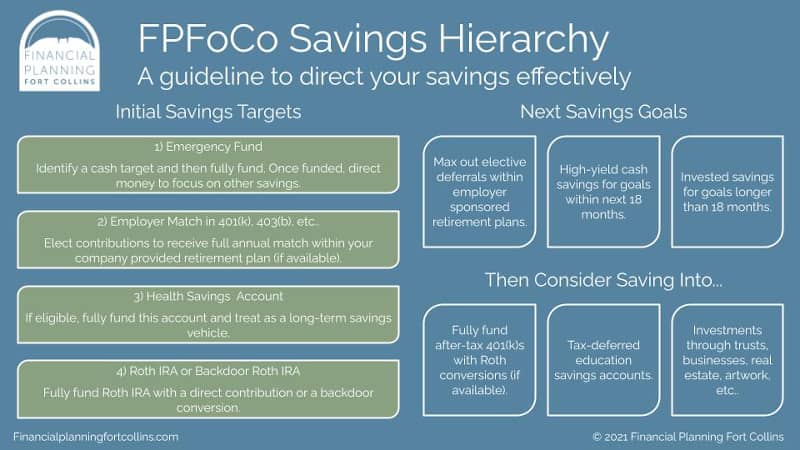

If you’re unable to contribute the maximum amount to your 401(k) plan due to the non-discrimination rules, simply follow our recommended hierarchy of savings.

You can find other tax-advantaged savings vehicles through individual retirement arrangements (IRAs) and health savings accounts (HSAs).

Pro Tip: If you’re in the situation where your employer returns some of your 401(k) contributions, consider a Backdoor Roth IRA contribution strategy. The limits for 2022 are $6,000 and an extra $1,000 if you’re over 50.

Other Creative Solutions

Catch-up contributions: If you’re 50 or older, the catch-up provision is available to you no matter your HCE or non-HCE classification. For 2022, you can contribute an extra $6,500 per year to your 401(k).

Focus on your spouse’s plan: If your household has another employer retirement plan available, then try to get the maximum in your own plan as an HCE, and then direct the other savings to your spouse’s plan. That way, your household can reach the $20,500 limit in at least one of your employer-sponsored retirement accounts.

Deferred compensation plans: Some companies offer official deferred compensation plans that offer similar investment options as a 401(k). The idea is that you postpone receiving some of your compensation by electing that money to go into a deferred compensation plan. You then will receive and recognize that money in future years through the plan’s payout rules.

These plans do come with risks. For example, the company may not follow through with the plan if it experiences financial hardship. If your employer offers a deferred compensation plan, be sure to analyze your options carefully.

Avoiding Discrimination Testing Issues

To ensure the plan is taking care of all employees in the company, you can remain an HCE but still contribute the full amount to your retirement plan by encouraging non-HCEs to contribute to their 401(k)s. This way, non-HCEs’ total contributions increase. Hopefully, more of your team members will bolster their own retirement savings and you can contribute a higher amount to your 401(k). To inspire other employees to participate, programs to auto-enroll all employees as well as educational materials to increase participation are available.

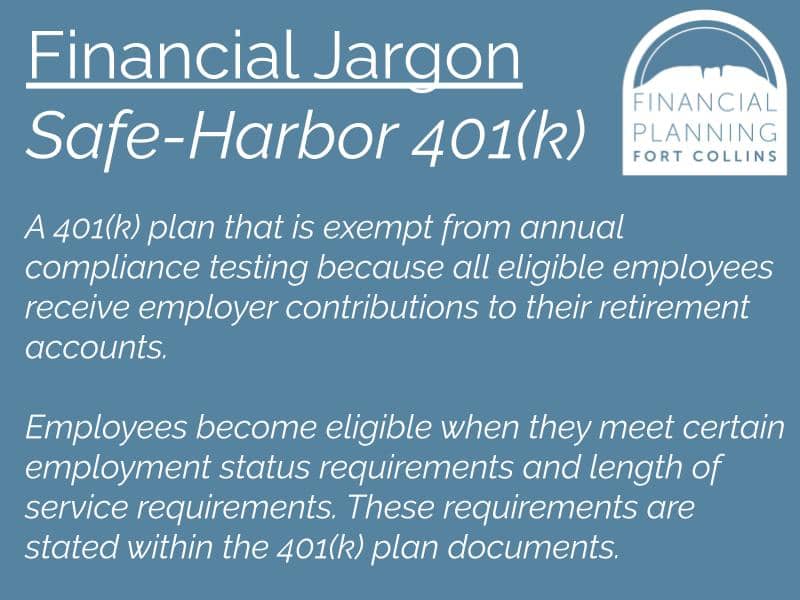

Switching to a Safe-Harbor 401(k) Plan

As a highly compensated employee, you may have some decision-making power within your company. To become exempt from the compliance testing for your company’s 401(k) plan, your employer can implement what’s known as safe-harbor provisions. This means that the employer needs to account for and provide some matching contributions on behalf of eligible employees.

To explore safe-harbor provisions, 401(k) providers can tell you the pros, cons, and costs associated with a potential transition. As you potentially bring this idea up to your employer, it’s important to remember that, no matter the size of the company, some added costs are associated with these safe-harbor 401(k) plans due to the mandatory employer contributions. However, the administrative burdens for safe-harbor 401(k) plans are much simpler than traditional 401(k) plans due to eliminating the need for non-discrimination testing.

Still Confused About Where to Save?

If you’re still struggling to identify the appropriate savings vehicle, here’s a strategy guide you can use for your own personal hierarchy of savings.