* This article was originally published on October 24, 2018. It has been updated for 2020.

Happy autumn!

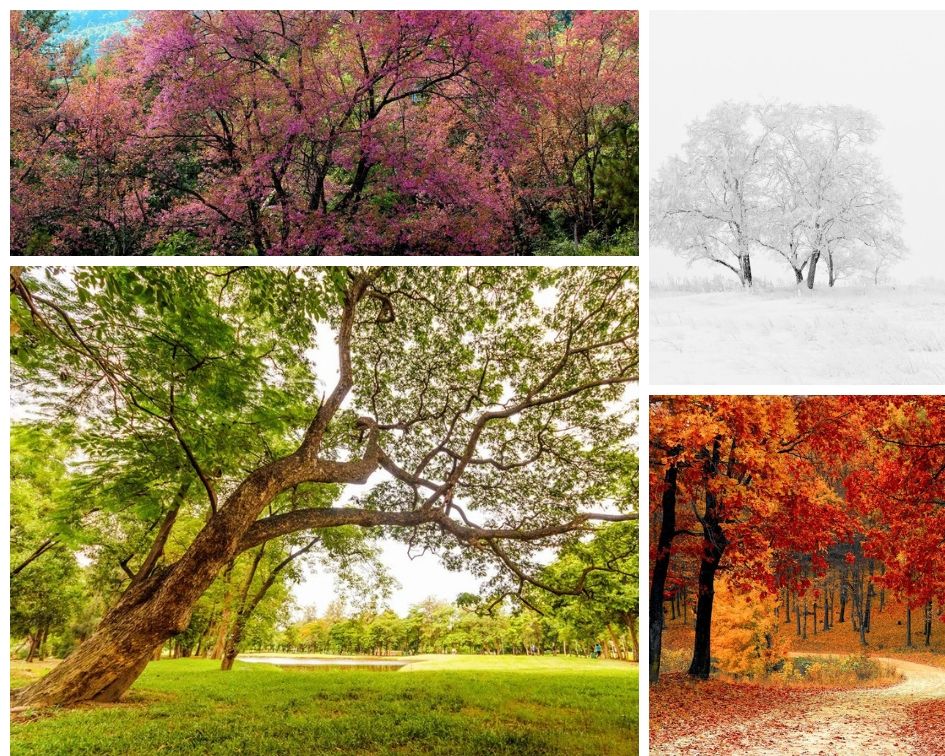

With fall officially having begun yesterday, we’ll soon be seeing leaves change colors as the days grow shorter. And with cozy sweaters and pumpkin spice everything just around the corner, it’s also the perfect time to consider the “seasons” that are part of so many financial planning journeys.

Where are you at in yours? As our lives change, so, too, do our goals and the ways we work to achieve them. The financial planning phases are similar to seasons, marked by major differences in individuals’ lives.

Like a new year, financial planning begins with spring accumulation and continues from summer prime earning and high accumulation to autumn retirement. The cycle becomes complete — and, in many cases, begins again — in winter’s late retirement. For many people, the seasons change along with the ways in which they view themselves, their investments, and their goals. But how can they — and you — plan for these seasons and adapt financial plans accordingly?

When you understand where you are now and where you’re poised to go, you can simplify the planning process and prepare for changes — even the unexpected.

The “seasons” of financial planning

1. Spring — Ah, spring. The beginning of a fresh cycle: new buds on trees, animals peeking out from hibernation, and baby birds hatching. Just as Mother Nature seems to bring the outdoors to life and makes those April showers rain down, the spring financial planning season is all about accumulation.

This season begins for most investors when they begin working and earning. While they’ve not yet made it to their prime earning years, the spring is no less important for financial planning. In fact, it’s a critical time to build a solid foundation for lifelong planning. After all, trees need strong roots to grow.

It may seem like spring is a difficult time for investors to plan as they’re being pulled in many financial directions. But that’s exactly why it’s important to begin planning in this phase. By tracking accumulation, budgeting for needs like student loan and mortgage payments, saving for emergencies, and establishing life goals, investors begin to anchor their roots in this springtime investment season. It’s this time that allows them to best prepare for the future.

2. Summer — By summer, those who started planning in their springtime phases have the roots they need to grow strong. As their branches spread outward and upward, reaching closer to the financial goals they set in the previous season, those roots continue to deepen.

While it can be more difficult for investors who begin their planning in the summer to make up for time lost during the spring, it’s not impossible. However, it can take a more aggressive approach — and often, a helpful green thumb in the form of a financial planner — to establish those strong roots later in the season.

This is because summer is the prime earning season for investors. Many become stable in their careers during this phase, advancing in their roles and enjoying the added income their expertise and seniority provides. This high-earning time is an opportunity for them to make the most of their income as they bear and store the fruit they’ll need to live comfortably throughout the fall and winter seasons.

3. Autumn — This is the retirement season of financial planning. Those who planned and prepared for this season in spring and summer now have sturdy trunks and roots, ready to live comfortably throughout their autumn and winter seasons. Many choose this time to plan for spring and new beginnings for others by planning their estates. By preparing to pass assets — monetary and otherwise — to friends, family members, charities, or other causes they believe in, investors can give a fresh start to their beneficiaries, allowing them to reap what the investors themselves have sown and continue the cycle.

But just as trees begin to lose their summer leaves, fall is also a spend-down period for many individuals as the assets they accumulated over the previous seasons support them. Planning, however, is still necessary as winter’s first frost nears.

4. Winter — As fall turns to winter and a blanket of snow graces the ground, a new season has begun: the late retirement phase of financial planning. Continuing to live comfortably — even if the winter is harsh — is what investors planned for throughout earlier seasons.

Following their financial plans remains important for those in this stage as does active estate planning. It’s necessary to continue adjusting financial plans as necessary throughout late retirement as needs change. Active estate planning also allows investors to leave gifts to their beneficiaries so they can begin their own financial planning journeys come springtime, set deeper roots or reach goals more quickly in summer, or bolster their own stores for autumn and winter retirement comfort.

Each season brings exciting changes for those in all of the financial planning “seasons.” With a holistic financial plan, you can prepare for each change and the legacy you’ll leave behind. Working alongside a financial planner can give you the guidance you need as you grow through every season — and the peace of mind to weather any storms that may come along the way.

[/vc_column_text][/vc_column][/vc_row]