As 2024 comes to a close, we take a moment to reflect on an incredible year for FPFoCo. From meaningful client improvements to team achievements and community contributions, this year has been all about growth, innovation, and strengthening the relationships that drive our success. Here’s a deeper dive into our highlights from 2024.

Client Success and Milestones

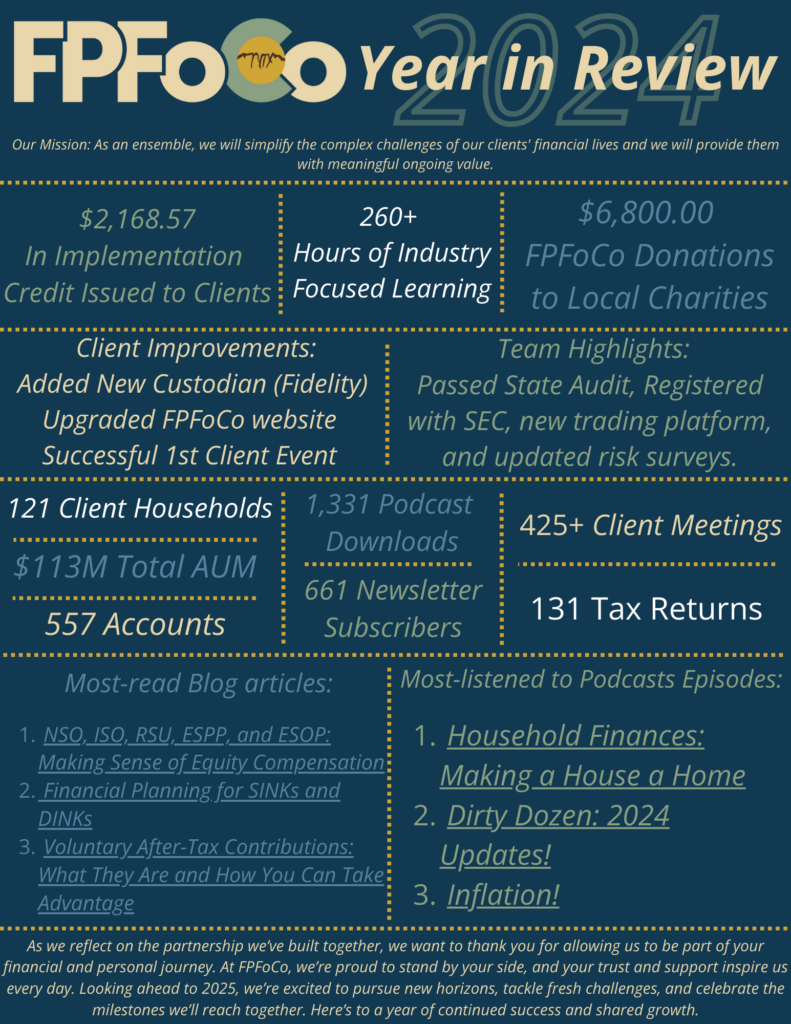

This year, we had the privilege of serving 121 client households across 557 accounts, managing $113 million in total assets under management (AUM) via our comprehensive financial planning services. Over 425 client meetings and 131 tax returns reflect our ongoing dedication to providing personalized and comprehensive financial solutions.

Some of the most exciting client-focused improvements included our partnership with Fidelity as our new custodian, a major upgrade to the FPFoCo website, and hosting our first-ever client event right here in Fort Collins. It was a fantastic opportunity to connect, share insights, and show our appreciation with some fun giveaways!

Strengthening Our Expertise

At FPFoCo, we believe in continuous learning to better serve our clients. This year, our team invested over 260 hours in industry-focused learning. This continuing education helps us to stay ahead of trends and regulations as well as provide cutting-edge advice and solutions.

Operationally, we achieved significant milestones, passing our Colorado state audit, securing SEC registration, as well as implementing a new trading platform and updated risk surveys. These advancements ensure that we remain compliant, innovative, and prepared to navigate the evolving financial landscape as we continue to offer unmatched comprehensive financial planning services.

Giving Back and Engaging with Our Community

Giving back has always been a core value for us here at FPFoCo. In 2024, we donated $6,800 to human-focused charities in our community. Additionally, we provided $2,168.57 in implementation credits to help our clients take actionable steps toward advancing their financial plans. This initiative is just one way we strive to reduce barriers and ensure clients feel supported every step of the way.

What’s Trending? Most-Read and Downloaded Content

Our financial education efforts also reached new heights. Our newsletter grew to 661 subscribers, while our podcast achieved 1,331 downloads this year. These platforms have allowed us to share insights, tips, and valuable resources on a variety of topics.

This year’s top blog articles included:

- NSO, ISO, RSU, ESPP, and ESOP: Making Sense of Equity Compensation

- Financial Planning for SINKs and DINKs

- Voluntary After-Tax Contributions: What They Are and How You Can Take Advantage

Our most-listened-to podcast episodes were:

Looking Ahead to 2025

As we reflect on the partnership we’ve built together, we want to thank you for allowing us to be part of your financial and personal journey. Your trust and support inspires everything we do, and these accomplishments wouldn’t have been possible without you.

Looking forward to 2025, we’re excited to pursue new horizons, tackle fresh challenges, and celebrate the milestones we’ll reach together. Here’s to a year of continued success and shared growth!

Not a client yet? See if our ensemble approach is right for you.

Head to our services page to learn more about what we do for our clients.