If you’ve already read up on incentive stock options (ISOs) and nonqualified/nonstatutory stock options (NSOs) in our blog on equity comp but have been wanting to take a deeper look, look no further. (And if you haven’t yet, you can head to NSO, ISO, RSU, ESPP, AND ESOP: Making Sense of Equity Compensation Alphabet Soup for the basics.)

NSOs and ISOs: A Quick Refresher

These stock options give employees — and sometimes directors, contractors, and other stakeholders — of a company the option to purchase the company’s stock, and they come in two common forms: NSOs and ISOs. The name and broad category of equity compensation they fall into is known as stock options.

If you’re thinking of puts and calls, you’re on the right track. Similar to calls available to the general public, NSOs and ISOs offer company stakeholders the right but not the obligation to purchase that company’s stock at a set price. But these equity compensation stock options are indeed different in several ways.

Both are a reason for employees to stick with their employers and for those employees to contribute to the company’s success, knowing that their options give them the opportunity to enjoy their share of that success. Of course, success isn’t a guarantee. The price of the underlying stock that the options represent could increase, stay the same, decrease — or even go to $0.

Now that you’re familiar with their similarities, let’s take a look at how NSOs differ from ISOs.

Stock Options (NSOs and ISOs)

1) Nonstatutory/Nonqualified Stock Options

You may see this type of stock option described as a Nonstatutory Stock Option, Nonqualified Stock Option, NQSO, NQO, or NSO. Nonstatutory Stock Options are the most common form of stock options and may be granted to various stakeholders including employees, contractors, and directors of a company.

In general, the benefit of accepting an NSO grant is the possibility for the underlying stock price to increase. Once granted, the company will likely require those who received the options to wait for a certain period before they’re able to exercise their options and purchase the underlying stock. In some cases, the options may be available for immediate exercise.

▶︎ Pros

You could see a nice payday at exercise if your company’s stock price increases during the vesting period.

Once exercised, you may be able to sell your exercised shares immediately or hold onto them. You can even sell in coordination with the exercise of your options to cover the cost of exercising. This is known as a cashless exercise.

▶︎ Cons

If the price of the stock falls during vesting, you could end up with effectively worthless options. This is called being “underwater.” Exercising the option would cost more than the stock is worth.

When compared with immediate cash compensation, the risk of forfeiting options because you did not meet vesting requirements is real. Options are meant to motivate and incentivize stakeholders. If you and the company don’t see eye to eye, your options may never make it through vesting.

▶︎ Taxation

NSOs feature relatively straightforward taxation.

When exercised, the difference between the exercise price and the underlying stock price (aka “the bargain element”) is taxed as ordinary income and generally reported on a Form W-2.

The income is subject to regular payroll taxes like FICA and Medicare as well as ordinary income tax.

When you sell the stock acquired with the option, the difference between the underlying stock price at the time of exercise and the sale price is taxed as a short- or long-term capital gain, depending on how long you own the stock after exercise.

Hold for one year or less, and the gain is taxed as a short-term capital gain, at ordinary income tax rates.

Hold for more than a year, and the gain is taxed at more favorable long-term capital gain tax rates.

If the stock price drops and you realize a loss, you can use it to offset capital gains or up to $3,000 of ordinary income for the year. And if you’re not able to use your full loss for the year, you can carry it forward indefinitely.

▶︎ Tips and To-Dos

The stock plan may allow you to transfer your NSOs to others in the form of a gift. If you’re feeling generous and also want to avoid a tax hit, you can consider this strategy.

NSO Pro Tip: Your company may not alert you that your options are about to expire, so you’re responsible for planning accordingly. Keep the expiration date of your stock options in mind, and consider exercising them over multiple years to spread out your tax obligations. Effectively dollar-cost averaging, this can prevent a sizable tax hit in the year if you wait to exercise all of your options in the year of expiration and also hedge against price volatility.

2) Incentive Stock Options (ISO)

ISOs have more strings attached.

They’re available only to employees and limited to $100,000 of cumulative value in the terms of the grant in any one year of exercise.

Say What? In short, if grants made in numerous years at various exercise prices exceed a total granted exercise value of $100,000 in any given year, the excess options automatically become NSOs.

There are also Alternative Minimum Tax (AMT) considerations but for good reason … ISOs can be much more tax-efficient when compared to their NSO counterparts.

▶︎ Pros

As with NSOs, you’re up for a payday if the price of the stock moves up. If your company has its initial public offering or — my favorite equity comp phrase — goes IPO and you hold ISOs, you could be in for quite the windfall.

Unlike NSOs, ISOs are not subject to payroll tax. This makes it entirely possible to not pay any tax (even AMT) at exercise for the purchase of substantially discounted stock.

▶︎ Cons

Exercising at a smaller public or pre-IPO company can have great rewards, but it’s not without great risk. Under the right circumstances, you could end up footing a hefty tax bill for stock that later becomes worthless.

Vested ISOs expire three months after your related employment terminates. This compressed timeframe to take action can lead to suboptimal outcomes. It’s important to consider this as a part of the totality of factors when making a career move (if you can control it).

▶︎ Taxation

With ISOs, the special tax treatment has a big upside, but it’s not so straightforward.

When ISOs are exercised, the difference between the exercise price and the underlying stock price (aka “the bargain element”) is subject to Alternative Minimum Tax (AMT) but not regular income tax.

This tax treatment is significant because it creates a lot of potential planning options. There are situations where one can thread the proverbial needle and miss AMT altogether. And even when paid, a taxpayer then unlocks a tax credit on the difference between regular tax and AMT in future years.

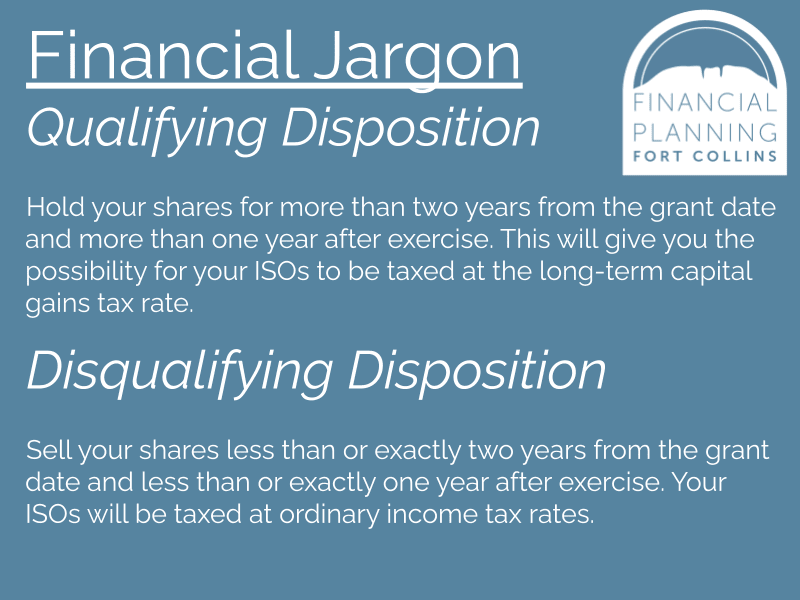

When the stock acquired with the option is sold, the holding period relative to both the grant and exercise date of the ISO determines the tax character and consequences of the stock sale. In general, sales made more than two years after the grant date and more than one year after the exercise date qualify for long-term capital gains treatment.

▶︎ Tips and To-Do’s

To have a qualifying disposition when you sell shares purchased by exercising an ISO, remember to hold your shares for more than two years from the grant date and more than one year after exercise. This will give you the possibility to be taxed at the long-term capital gains tax rate instead of ordinary income tax rates.

ISO Pro Tip: Don’t be afraid of disqualifying dispositions as a rule. The economic substance of the transaction along with an understanding of current and future tax liabilities (both regular tax and AMT) may lead to the conclusion that a sale sooner, rather than later, makes more sense for your financial plan.

Calendar year “bookend” exercise strategies are the most flexible for their own reasons. Early-in-the-year exercise lets you get a good look at the stock’s performance while you contemplate whether to hold through the one-year period or cut ties before the end of the tax year for a short-term gain and no AMT to concern yourself with. You also start the gain clock sooner in the tax year if you continue to hold for a qualifying disposition.

Utilizing year-end tax planning to identify how many ISOs you can exercise without triggering AMT provides an opportunity to take maximum advantage of your plan while not dealing with additional tax liability. Now you know why we’re looking at this late in the year with some proactive tax planning.

Different Equity Comp?

If you receive a different type of equity compensation, we have blogs for you! Learn more about restricted stock units (RSUs) and employee stock purchase plans (ESPPs). If those two don’t apply to you, subscribe to our blog so you don’t miss our future article on employee stock ownership plans (ESOPs)!

For a hands-on approach to your equity compensation, find a convenient time to meet. We’ll create an equity compensation spreadsheet with your relevant details. Then we’ll help you better understand how everything works, from your strike price and waiting period to your available exercise date so you can maximize the value of this employee benefit.