You get a grant notice from your employer explaining that you have been or will soon be awarded restricted stock. “This is great!” you think. “Free stock. The chance for some upside if the company does well.” But …

Are they restricted stock units (RSUs) or restricted stock awards (RSAs), otherwise known as restricted stock? (I’ll stick with the fomer to differentiate and keep things simple here.)

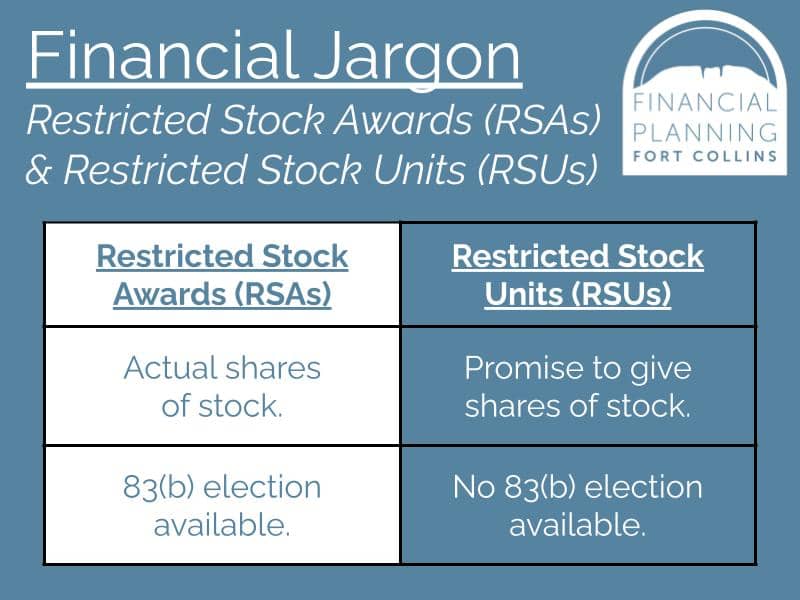

Restricted Stock Units (RSUs) vs. Restricted Stock Awards (RSAs)

Restricted Stock Awards (RSAs)

With RSAs, actual shares of stock are granted to an employee with restrictions as to when they may sell or otherwise dispose of the stock. The vesting of RSAs is typically based on specific performance goals and/or, more commonly, time worked at the company.

Because RSAs involve actual shares of stock — the value of which is ascertainable as of the grant date — owners of RSAs are allowed voting and dividend rights along with the ability to make a special tax election under IRC Section 83(b).

Consider making a Section 83(b) election within 30 days of receiving a grant of RSAs. The election will make the value of the stock taxable to you as ordinary income (including Social Security and Medicare payroll taxes) based on the value as of the grant date. This allows for the reward of potential lower capital gains tax rates on the gain after the stock vests and you sell it (assuming that date is one year and a day after the grant date).

The primary risks are:

1. The stock never vests because you leave the company or the company closes.

2. A significant decrease in the stock price between the grant and vesting/sale dates.

In both risk cases, you end up recognizing and paying taxes on income you never realized.

Without an 83(b) election, you will pay ordinary income and payroll tax on the RSAs as of the date the stock vests to you (aka the date it becomes unrestricted). Any gain from that date forward is taxed as a short- or long-term capital gain, depending on how long you own the then unrestricted stock.

For the RSAs of a pre-IPO company the rewards of a Section 83(b) election can be extraordinary … but the risk significant.

At the time of the grant, there are no taxes to pay, no special elections to make — e.g., no Section 83(b) election for an RSU — and no nifty trading strategies to contemplate.

In order for these shares to actually come into existence and for you to receive them, you must wait until your RSUs vest. Companies impose different restrictions and requirements on the vesting of RSUs, and your grant agreement will communicate the terms associated with yours.

These awards exist as a way to promote loyalty and encourage commitment to the overall success of the business. Although they’re more commonly awarded to employees, RSUs are granted to non-employees in some cases as well.

Many grants will require that you remain employed or associated through a specific date or dates — sometimes several years — in the future. Other grants will also require you to achieve specific milestones before awarding the actual stock. These specific types of grants are sometimes referred to as performance stock units (PSUs).

Where to Get Information About Your RSAs or RSUs

The main document(s) to help you understand your RSAs or RSUs are your stock plan, grant agreement, grant notice, or the like. This document typically looks like a legal document with provisions, restrictions, and other detailed language.

Pro Tip: It’s important to know there’s generally not one universal document if you have multiple types of equity compensation. If you have multiple awards, you’ll likely have a separate grant agreement for each of your awards, and your employer may implement different features for different equity comp plans. We ask clients to share each separate grant agreement, stock option plan, and other informational documents about their equity compensation plan(s).

▶︎ Vesting Terms

The single most important part of a grant notice is the vesting terms. You gain control of actual stock once you meet these terms. When you receive actual stock, you are then able to make decisions on whether to hold and/or sell the shares.

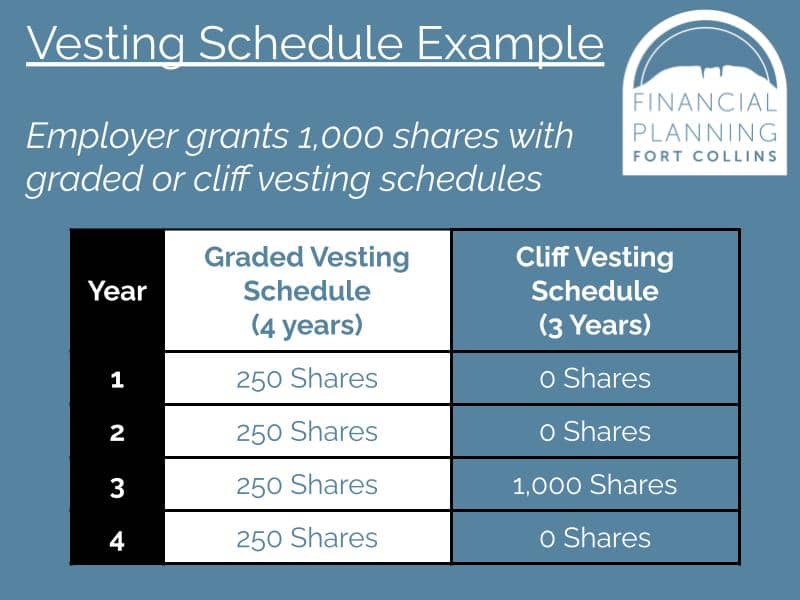

▶︎ Time-Based Vesting

For time-based vesting, you will find graded or cliff vesting schedules. Graded vesting means that you receive the stock in installments. Cliff vesting means that you receive the stock all at once.

▶︎ Performance-Based Vesting

To incentivize employees to make the company more profitable, some RSU and most RSA grants tie the vesting of the awards to measurable metrics of performance. The plan document will show the milestones and formulas that the company considers.

▶︎ Double-trigger vesting

Pre-IPO companies that use RSUs will typically have what’s called double-trigger vesting. The first trigger is the more common time- or performance-based vesting with the second being a liquidity event. This solves the issue of illiquid stock being taxable without a means of selling shares to raise cash and/or pay the taxes.

▶︎ Trading Restrictions

If the stock involves a publicly traded company, you may be limited to specific timeframes during which you can sell your shares. If these restrictions apply to you, your company will typically share an insider trading policy and may reiterate it in the grant notice.

What to Do with RSAs and RSUs

Pro-tip: When RS or an RSU vests, ask yourself this question: “If this were cash, would I use it to buy this company’s stock?”

If your answer is “no,” consider selling the shares immediately and deploying the cash as you otherwise would in your financial plan. This will limit your your investment exposure.

How do these positions work in your financial plan? We see many clients begin to get top-heavy with their financial net worth tied to their employer’s stock. This is where you should start to contemplate your employer’s role in your financial well being. It’s important to recognize that you can wield complete control over very few parts of that situation, but the amount of your employer’s stock that you own is something you can, for the most part, control completely.

Timing Your Sales

▶︎ Option 1: Sell Immediately

Some plans allow you to make an immediate and automatic sale after vesting by selecting this strategy ahead of the vesting date. If this option isn’t available, you may have to wait a few days after vesting for the actual stock to post and settle in an account where you can sell it.

With RSUs, because you’ve already been taxed at vesting, selling immediately doesn’t change your tax outcome very much, if at all. Different story if you made the 83(b) election on your RSAs.

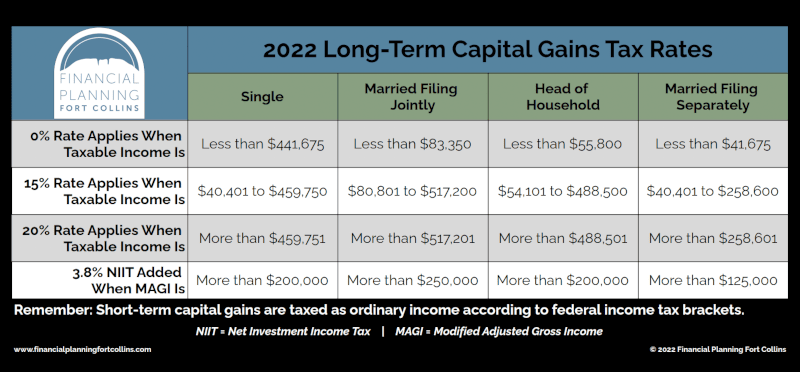

▶︎ Option 2: Hold For More Than a Year

If you have no better alternatives or needs for the stock you receive — or you just think the stock is going to kick butt — a consideration would be to hold the stock for at least a year and a day.

When you do this, you’ll receive the benefit of more preferential tax rates at the federal level on any growth in the price of the stock over that year or longer. Since you’ve already been taxed through your 83(b) election or at vesting, remember that you’ll only owe additional tax on the difference between what you sell the stock for and its value when you were taxed.

▶︎ Option 3: Indecision(?) aka Hold for a Year or Less

This probably happens more often without planning but can certainly happen with it as well. If you’ve decided to let your stock ride, you may run into a scenario where you need to sell it sooner (as in one year or less after it vested) than later.

If you do sell it within a year, you’ll be subject to additional ordinary income taxes on any growth between the date you were taxed and the date you sell it. Sometimes, however, it’s important to remember to not let the tax tail wag the dog. If you need the cash and this is the place it makes the most sense to get it from — it is what it is.

▶︎ No Matter Which Option You Choose, Keep Track and Keep Planning

Overall, keep detailed track of your positions. We do this for you so that you can visualize your equity compensation in one place, foresee future vesting events, and identify when it makes the most sense to sell your vested positions.

Some strategies to consider with your RSAs and RSUs:

You can track upcoming vesting schedules for times to replenish your checking account so you can commit more of each paycheck to your 401(k) contributions.

Instead of generating savings for future financial goals (like a home purchase or college funding), you can coordinate future vesting events with these financial goals. This way, you don’t have to keep too much money in cash, thus exposing your savings to purchasing power risk (aka inflation).

Remember, if your company gave you the option to receive the value of these shares in cash, would you go and purchase your company’s stock with that money? If the answer is “no,” you may consider selling your positions to diversify your financial net worth.