In honor of Independence Day, we wanted to bring you a sneak peek of our latest FPFoCo Academy module. Our newest installment is called “Planning for Financial Independence,” and you can access the entire course right now. Just head to the Academy and log in! There, you’ll learn how you can:

- Define your own goal for financial independence (in this sneak peek).

- Forecast your future financials.

- Earn more. Spend less (in this sneak peek).

- Follow your personal hierarchy of savings.

- Monitor, tweak, and review on an ongoing basis.

These steps can help you reach financial independence. Yet, in order to reach this phase, you need to do the hard work to give yourself this opportunity.

Define Your Own Financial Independence

The FPFoCo client experience involves aggressive savings strategies. For example, you likely have seen or will see us recommending a savings plan that typically involves this saving hierarchy:

- Set aside an emergency fund.

- Utilize your employer-sponsored retirement accounts.

- See your health savings account as a long-term savings account.

- Open and fund IRAs or Roth IRAs.

- Take advantage of tax incentives where and when you can.

With these savings strategies, you contribute more money to your financial net worth over time versus spending elsewhere. Thus, you can achieve financial independence on a timetable that makes sense for you.

You may have heard of people who are part of the Financial Independence, Retire Early, or F.I.R.E., movement who intend to retire at young ages. An appropriate self-proclaimed word to describe the financial bloggers who promote the F.I.R.E. movement: extreme. These people embrace extreme savings and budgeting. For example, many people within this movement proclaim that they save 70% or more of their income.

These savings habits aren’t the reasons why this personal financial lifestyle is a movement. It goes back to why these people are saving money in the first place.

Examples of the F.I. Community

Many people in financial independence, or F.I., communities are relatable and profiled in short videos in MarketWatch’s Fire Starters series. Here’s one couple’s example of what F.I. means to them, their habits when it comes to everyday expenses, and how they’re trying to inspire others to make better money decisions.

The Types of F.I.

Many people within the F.I.R.E. community talk about F.I. as their personal goal post to the second part of the acronym, R.E. (retire early). A common question in this community is, “How many years are you away from F.I.?”

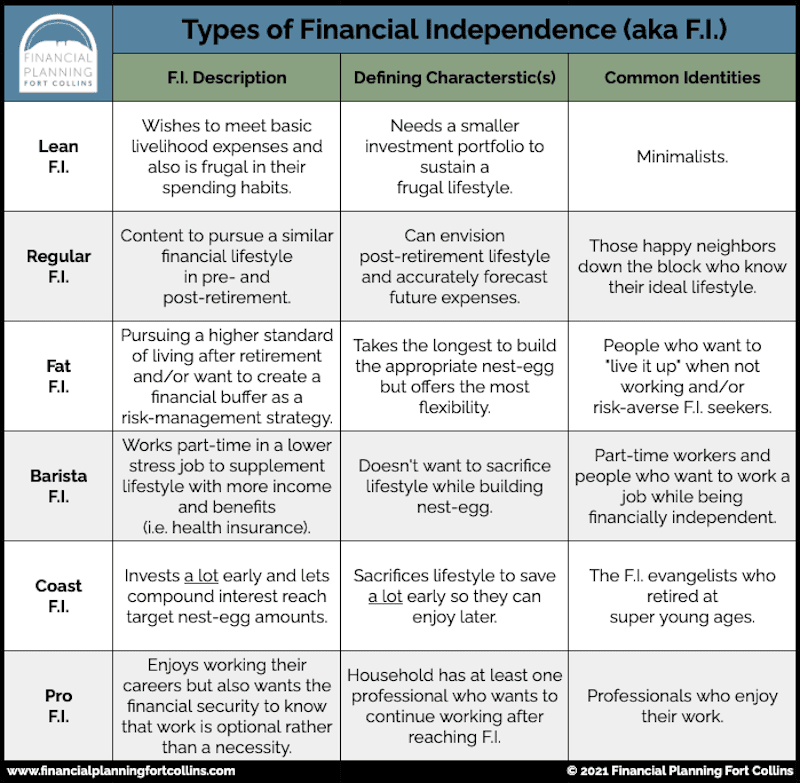

There are many different calculators available on the web to help you understand the basic principles of determining your F.I. number. And within the F.I. community, many different types of individuals exist with different styles of F.I.

Some of these identities are self-proclaimed, and some of them are labeled. Yet, as you contemplate pursuing your own financial independence, how do you envision your personal style when it comes to F.I.? See which label makes sense to you. This can help you understand what kind of journey you may be embarking on as you pursue F.I.

How to Define Your Own Financial Independence

Many of our clients identify with the Pro F.I. definition since many of them enjoy their careers and don’t mind working after reaching financial independence. However, the mental benefits of knowing you have the necessary savings to then think of your work as “optional” is a worthwhile pursuit.

A recipe for financial independence begins with some self-exploration. To start planning your ideal life, start with these four categories of how you envision your financial independence.

1) Lifestyle

How do you want to spend your financial independence? Will you be participating in “optional work,” working in a part-time job to supplement your financial life, or enjoying the “good life?” Do you want to partake in expensive hobbies like sailing or more frugal hobbies like gardening at home? How do you want to spend your life energy?

2) Location

Which locations accommodate your ideal lifestyle? Do you want to live there full time, part time, or plan multiple visits from time to time? Where do you want to spend your financial independence? Will you be in a country home, the suburbs, or a city condo? The cost of living associated with your primary residence is a crucial factor when planning your future independence.

3) Spending Needs

With your desired lifestyle in mind, how much money do you anticipate needing to spend annually?

4) Income Needs

Voila! With your spending needs identified, you now have a number to help you start calculating your anticipated nest egg that matches your unique definition for financial independence. Now, the math nerds at Financial Planning Fort Collins can get to work!

Identify and Commit

Just as with almost everything else, you may need to do some grunt work at the beginning as you experience the learning curve. Then you’ll hopefully have multiple income sources on autopilot later to meet your income needs.

Below, you’ll find a high-level list of potential income sources for you to explore. We encourage you to dive into an area and make some S.M.A.R.T. goals to put you on the path toward more income. This can open up new doors for your career, protect your household’s financial health, and make your income life less wobbly.

▶︎ Side hustles and businesses

- Consulting

- Monetizing your hobbies

- Doing contract work with other companies

- Creating a side-business

▶︎ Sharing and gig economy

- Drive for ride-hailing programs

- Offer short-term rentals of your home or possessions

- Perform tasks and do errands

- Work in other app-based gig marketplaces

▶︎ Investing

- Rental real estate

- Dividends and interest

- Angel investing

▶︎ Passive Income

- Web-based content (photography, books, websites, e-courses, etc.)

- Copyrights, patents, and usage rights

- A plethora of other options

Ask your friends and family or search the internet for new, creative, and sometimes odd ways to make money. Be sure to use your best judgment and research the opportunities.

There’s plenty of money out there, and you sometimes need to find creative ways to get some.

Save More, Spend Less

When crafting a financial independence plan, a large component is matching your forecasted annual spending with annual distributions from your savings.

Forecasted annual spending may not be the sexiest phrase in the financial world. Yet, it’s the second-most important aspect when pursuing financial independence.

- The first is building and having the savings available when you’re in retirement.

The good news is that you can control this “spending less” part of the process with your day-to-day, week-to-week, and ongoing habits. So you can actively prepare for your retirement lifestyle by cutting your spending today. This helps you connect the dots between your future self and your current self.

We have an entire module (Budgeting Styles & Strategies) dedicated to budgeting habits, which I encourage you to revisit. In the meantime, here are some high-level tips on how to forecast your future spending.

1) Track Where You Are Now.

Participate in some forensic accounting if you haven’t analyzed your spending habits yet. It’s easier to forecast your future spending if you can visualize how you’re currently spending. You can schedule another cash-flow meeting with our team and/or use a budgeting app to monitor your spending habits.

2) Where Can You Tighten the Belt?

Once you know your current spending, you may identify where you can decrease your expenses.

Understanding the difference between your “wants” and your “needs” can help you prioritize how, where, and when you want to direct your spending. Saundra Davis, a financial coach, has a great phrase that she repeats often:

Get intentional with your expenditures. What is it that makes you happy, fulfilled, and content? Identify those, and then try your best to spend your money on what gives your life energy — then cut expenses on everything else.

3) Monitor, Tweak, and Review

You can prepare to spend less in your future independence while also training yourself during your asset accumulation years. This ongoing habit to monitor, tweak, and review your spending is likely to pay dividends — or, I mean, save pennies — while you prepare for financial independence.

And you’ll also have these money management skills as you eventually transition into your life with “optional work.”

Now that’s a freeing feeling!

Looking for more on financial independence? In the FPFoCo Academy, you’ll find the full personal finance module, Planning for Financial Independence, as well as a Strategy Guide to help you get started on your path to financial freedom!