✅ Know where your employer-sponsored retirement plan or IRA account is and where you want it to go.

✅ Review your rollover options and decide on the best one for you. Be sure to consider the potential tax implications of indirect rollovers — and how you can avoid them. Don’t forget that the type of account you have and the custodian it’s with could limit your options.

✅ If you’re rolling your plan over to another employer plan, contact the receiving plan administrator — where your rollover is going — to verify that they’ll accept your rollover. You might also want to ask about how to begin the process in case they can help you start your rollover.

✅ Contact the delivering plan administrator or custodian — where your account is now and where your rollover is coming from — to get the process started.

✅ Mark your calendar! Set a reminder for when you should expect your check to arrive in the mail. This is usually seven to 10 business days unless you choose expedited delivery.

✅ Prepare your envelope to forward your check — or download the receiving custodian’s app if they offer check upload tech — so you can get your deposit in and have your money working for you again asap! If you’ve selected the indirect rollover option, be prepared to deposit your check — along with funds equal to the 20% mandatory tax withholding, if applicable — within your 60-day rollover window.

✅ When you receive your check, if you chose the direct rollover option, don’t endorse it! It should be written out to the receiving custodian, so this might be less tempting than you think.

✅ Mail your check or use a mobile deposit option, then monitor your account to be sure that your receiving plan or custodian received your check and that the correct amount made it into your account.

✅ Invest your funds appropriately at the receiving plan or custodian.

✅ Don’t forget about those tax forms! Be on the lookout for Form 1099-R come tax season. You might want to add a calendar reminder as a note to self to download or look for the form in the mail come tax time so it doesn’t come as a surprise.

Wondering how you can get your rollover started, where you should mail that check so it makes it to the right account, or how to invest your funds once they reach their destination? If you have these questions or just don’t know what tax form you should be expecting, read on.

Whether you’re starting a new job, have multiple retirement plans from former employers scattered among accounts or custodians, or you’ve gotten a notification of long-lost retirement plan funds, the reasons for pondering a move — aka a rollover — are myriad. Your old plan might have higher fees or lack investment options, or you may just want to consolidate your accounts with fewer custodians.

Whatever your reason for a rollover, here’s how you can get started — and what you should know both ahead of time and along the way.

Your Options

Cash Out

When it comes time to move your retirement plan, your first thought might be to take the cash. But, if you’re under age 59½ or you’re retiring from your current employer and you’ll be under age 55 at the end of the year, that might not be your best option.

Sure, your current or former employer plan could cut a check in your name, but you’d be subject to a 10% early withdrawal penalty on the funds you take in cash — and the amount you take would be added to your ordinary income. This is the law’s way of trying to prevent you from taking these funds pre-retirement. While that might not sound so bad, don’t forget that your ordinary income is taxed, so a retirement plan distribution in cash could bump you up into a higher tax bracket. In this case, you’ve also got 20% mandatory withholding to think about (more on that later).

If you’re considering whether to take the money and run, be sure to talk to your tax professional to understand how the distribution will affect you.

Move to a Different Employer Plan

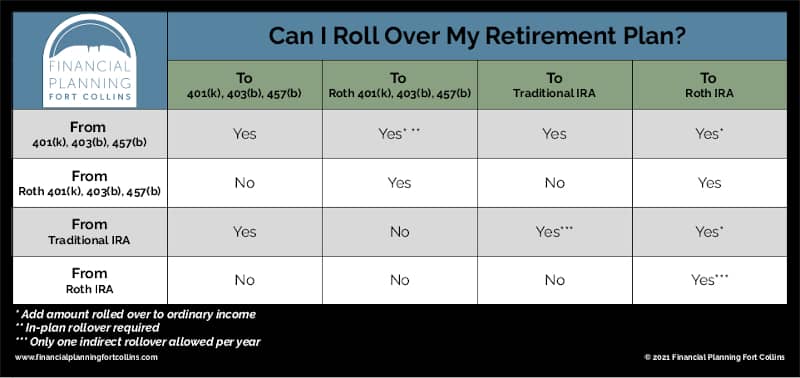

So if you don’t want a check written out to you, what about a check written out to your account with a different plan? The first thing you’ll want to consider here is what type of account you have. Check out the rollover table below. There, you’ll see where some of the most common account types can and can’t go. It may help you to better understand whether you can move your plan — and if you can avoid a taxable event.

Thinking you’ll move your plan to a different employer-sponsored retirement plan to avoid a potential tax impact? Your next step is to check with the plan administrator for that plan.

This is an important step because employer-sponsored retirement plans are not required to accept rollovers. So before you start making moves, don’t forget to check.

Another important note: Required minimum distributions (RMDs) from employer-sponsored plans are not eligible for rollover. That means you’ll have to take your RMD in cash.

Move to an IRA

Say you’ve got an IRA. This is another place where you could move your employer-sponsored retirement plan, and IRAs are pretty easy to open. Select a custodian (e.g., an eligible bank, brokerage, or trust company), submit an application, pause for processing, and you’re there!

For some, this is a great option. It can be especially useful for retirees who want to consolidate all of their pre-tax retirement plan dollars into one location. That’s because it’s one place to keep an eye on such funds and one account to keep track of for withdrawals and tax purposes.

But for those who haven’t retired yet, it may not be the best option. Why? For one, an IRA isn’t a qualified retirement plan. Rather than being a qualified — read: employer-sponsored — retirement plan, an IRA is an individual retirement arrangement, so it’s subject to a different set of rules in the eyes of the Internal Revenue Service (IRS).

Which rules? There are a few more opportunities available for withdrawing funds from an IRA while avoiding the 10% early withdrawal penalty when compared to employer plans. But IRAs don’t offer the option to withdraw funds without that penalty if you separate from service — aka retire — during the year in which you reach age 55.

Another consideration is your ability to contribute to a Roth IRA. If your income is under the Roth IRA contribution phaseout limit of $125,000 for individuals or $198,000 for couples who file taxes as married filing jointly in 2021, having pre-tax funds in an IRA isn’t an issue. But if you’re earning more than those limits, you might want to think twice about moving funds into an IRA.

That’s because “backdoor” Roth IRA contributions rely on having no pre-tax funds in your traditional IRA on 12/31 of the year in which you perform the conversion (see below).

Taxed Rollovers (aka Conversions)

One type of rollover that’s unlimited in amount is a Roth conversion. Technically still a type of rollover, a conversion involves moving pre-tax retirement funds to a Roth account. The catch here is that you must add any amounts converted from a pre-tax plan to a Roth plan to your ordinary income. Why? When you added the funds to your pre-tax account, you hadn’t yet paid taxes on those amounts — and the dollars weren’t included in your income.

The IRS wants their piece of the pie here. So if you’re converting, be ready to add the conversion amount to your ordinary income — and prepare to pay taxes on that amount. As you can see in the table above, taxes apply when rolling over 401(k), 403(b), 457(b), or IRA funds to any type of Roth account.

The upside? Once converted, qualified distributions are tax-free in the future. This could be huge but careful planning is needed.

Direct or Indirect?

You’ve decided to avoid the potential tax hit of taking your employer retirement plan funds in cash and are instead going to move them to a different employer plan or your IRA. The next question to ask yourself is, “How do I want to complete the move?”

Moving your money might seem simple enough, but there are some important intricacies to be aware of — including that tax hit creeping back up on you. Let’s take a look, starting with a couple of definitions.

Direct rollover: Your old employer-sponsored retirement plan administrator cuts a check to your new plan. They may send the funds directly to your new plan or even to you, but the latter only leaves you as the middle person. Since the check isn’t payable to you, you’re not receiving a distribution.

Direct rollovers do not involve a time limit. However, the closely related indirect rollover does.

Indirect rollover: Similar to a direct rollover, your plan administrator or IRA custodian cuts a check — but, in this case, it’s got your name and your name only on it. That means you could cash the check and take all or some of the money for yourself … without ever rolling it into another plan or IRA. Here, the IRS gives you a time limit of 60 days to get it to your new plan or IRA custodian. This is also known as a 60-day rollover, and if the distribution is coming from an employer-sponsored retirement plan, it’s also subject to 20% mandatory tax withholding.

With the mandatory withholding, your plan administrator sends 20% of your rollover amount to the IRS, so you won’t see your full account balance on that check. If you don’t complete a rollover, the amount not rolled into the new account (including the mandatory withholding) is taxable as income and subject to a 10% tax penalty.

To avoid the tax hit with an indirect rollover, you have to add an amount equal to the withheld amount to your rollover. Yes, this means that you’ll need to make up the difference from other funds. If you do this, your full rollover is tax-free and you skirt that 10% penalty.

One caveat of the indirect rollover option for IRAs: Although there is no mandatory tax withholding, if you’re moving funds from one IRA to another IRA, you’re limited to one rollover every 365 days. That means you can’t roll any funds into or out of any IRA you own for a full year after your IRA-to-IRA rollover.

What About Trustee-to-Trustee Transfers?

Trustee-to-trustee transfers only apply to IRAs. Therefore, this type of transfer isn’t possible with an employer-sponsored plan type.

Trustee-to-trustee transfer: With this movement method, your old IRA custodian moves your assets directly to your new IRA custodian, i.e., trustee to trustee. You don’t have to worry about getting a check, so there’s no 60-day limit or tax withholding.

On the bright side, the one-per-year rollover rule for IRAs only affects rollovers. There’s no limit to the number of trustee-to-trustee IRA transfers you can accomplish in a year.

Action!

After you’ve decided on the method to use — and confirmed that the receiving plan or custodian is willing to receive your rollover — it’s time to get rolling. Give your delivering custodian a call, and they’ll walk you through the process.

Keep in mind that you may be receiving the check (regardless of who it’s made out to) and that you might be subject to a time limit for getting it to the receiving plan or custodian. Most delivering custodians will send your check shortly after you request your rollover, but getting it through the mail tends to take seven to 10 business days, although some custodians offer an expedited option for a fee. While the regular mail time frame is usually sufficient, you might choose the speedier delivery option if you want to limit the amount of time your retirement plan funds are out of the market, aka in cash instead of invested.

Pro Tip: Set a calendar alert to remind you when you should receive your check, then watch your mailbox for delivery. If you chose the direct rollover option, prep your forwarding envelope in advance. This way, as soon as you see the check in the mail, you can swap envelopes and get it back in the mail to your receiving custodian. Remember not to endorse your direct rollover check: It’s written out to your receiving custodian — not to you!

If you chose the indirect rollover option, set two calendar reminders. One for when you should receive your check in the mail and another one for 60 days from the date you actually receive the funds. When you receive your envelope in the mail, it’s a good idea to cash that check and cut a fresh one — along with the 20% withholding amount added — to your receiving plan or custodian asap. This will help you avoid paying taxes on your rollover as well as the 10% early withdrawal penalty, if applicable.

As an alternative to old-school snail mail, many custodians now offer mobile check upload options. This is similar to snapping a photo of your check and depositing it to your bank accounts via your bank’s mobile app. It’s also a quick and easy way to get your rollover check out of your hands and into its destination account faster. Not all custodians offer mobile uploads, and some limit check amounts or have other restrictions, so you might want to ask about uploads when you call your receiving custodian to see if they’ll accept your rollover.

After you’ve mailed your rollover check, keep an eye on the receiving account to make sure it arrives as expected — and in the correct amount! Once your funds land in your destination account, it’s time to invest. If you haven’t assessed your risk tolerance lately, now’s the time. Also, check in on your time horizon, especially if it’s been a while since you considered how it might impact your investment choices.

In addition to monitoring your investments, adding to them when possible, and rebalancing your account as necessary, don’t forget about taxes! Even if your rollover wasn’t a taxable event, it is a tax-reportable one, so you’ll still receive a form from your delivering plan or custodian with info to include on your tax return for the year in which you completed your rollover.

Experts on Your Side

Guidance on employer plans and accounts with outside custodians is included in your comprehensive services package. Whether it’s assistance with an account — wherever it is! — paperwork we can lend a hand with, or something else, we’re here to help!

So, as a client, instead of going through the 10 steps above, try these three instead:

1. Let us know that you’d like to roll over your account, securely upload your most recent statement, and grab a spot on our calendar so we can call your plan administrator or custodian together. We’ll select the rollover option that best fits your needs — acting as a fiduciary, of course! — and plan for your rollover.

2. When you get your check, mail it to your receiving plan or custodian. Or, if you’d like to deposit it into an account we manage for you at TD Ameritrade, just mail it to our office. We’ll take it from there!

3. If you’re rolling your funds to a new employer-sponsored plan, securely upload your menu of investment options and set up a time for a screen share. We’ll help you invest according to your risk tolerance, time horizon, and financial plan. Of course, if your check is going to an FPFoCo-managed TD Ameritrade account, we’ll invest it appropriately for you.