Jason’s Financial Favorites: Health Savings Accounts (HSAs)

* This article was originally published on June 5, 2019. It has been updated for 2020.

Let me start with three simple words: I love HSAs.

Since a health savings account (HSA) is basically a savings account for your health care, that might sound like a bold statement. An HSA might not seem all that “lovable” right off the bat, but HSAs are also so much more than what’s in the name. Their real value lies in the fact that HSAs have

▶︎ upfront tax benefits similar to a deductible traditional IRA,

▶︎ tax-free withdrawal benefits similar to a Roth IRA, and

▶︎ the ability to contribute regardless of income.

That means, by saving in an HSA, account holders get to skip out on paying income taxes (and possibly payroll taxes) on the cash they stash there. It comes down to more of your money going toward your needs — and less going to Uncle Sam.

To better understand the benefits inherent in HSAs, let’s take a little trip back in time.

A (Very) Brief HSA History

Predecessor MSAs, or Medical Savings Accounts, were available in some states as early as 1996. MSAs are similar to tax-free savings accounts, created to avoid insurance overuse by shifting some of the cost burden to consumers.

Then, not that long ago — in 2003 to be exact — former President Bush signed the Medicare Prescription Drug, Improvement, and Modernization Act, creating HSAs. HSAs are much more widely used today, although MSAs are still available in some states.

How HSAs Work

While HSAs may seem a bit confusing at the outset, they’re rather simple to understand and use. Let me break down the basics.

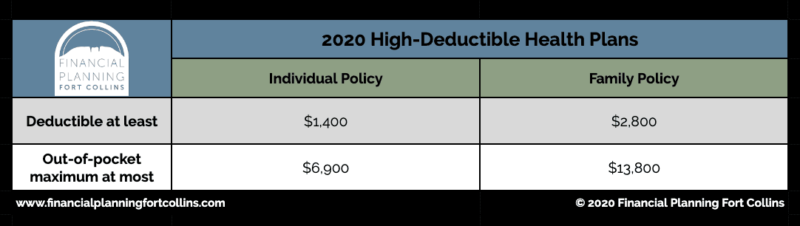

To be eligible to open an HSA, you must have coverage through a high-deductible health plan (HDHP). What’s does “high-deductible” mean, exactly? To qualify as an HDHP in 2020, your health insurance policy must have a deductible of at least $1,400 if you have an individual policy. Family policy deductibles must be at least $2,800. Those policies must also have an out-of-pocket maximum no higher than $6,900 for an individual or $13,800 for a family. While these amounts might seem high, having an HDHP usually means paying lower monthly premiums.

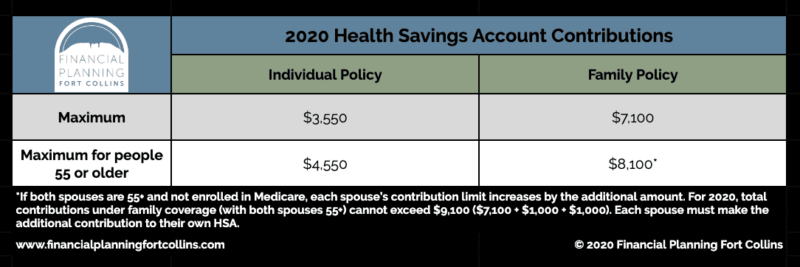

If your health care plan meets the qualifications, you can open an HSA. Sometimes you will find that the HSA is bundled with your health insurance or through your employee benefits. But you can also open an account at a bank or credit union. With an HSA-eligible health insurance plan, you can contribute a maximum of $3,550 to an HSA if your HDHP covers only yourself. If your HDHP covers you and at least one dependent or your spouse, you can contribute up to $7,100. Plus, if you’re 55 or older, you can add an extra $1,000 “catch-up” contribution, allowing you to save more before retirement.

How do you contribute? Many employers allow their employees to make deposits directly into their HSAs through payroll. If you don’t have this option, you can contribute after-tax dollars and deduct any contributions from your gross income on your tax return.

What HSAs Do

Now that you understand what you can do with an HSA, let’s explore what an HSA could do for you:

▶︎ You may be able to add cash to your HSA tax-free. Growth in your account is also tax-free. And, when applied to qualified medical expenses, the funds you take out of an HSA are tax-free. That’s a triple tax advantage!

▶︎ Using tax-advantaged HSA funds to pay for health care essentially means paying less overall.

▶︎ Setting money aside regularly to build up your HSA is an easy way to build a good habit of saving.

▶︎ You’ll have the funds available for some of life’s most potentially expensive emergencies.

▶︎ You can spend funds from your HSA via a credit card. Eligible expenses include copays, prescriptions, deductibles, and more. This even includes eye doctor and dentist expenses.

▶︎ If you later select a health insurance policy that isn’t HSA-eligible, you can’t continue to fund the account. However, you can keep your funds in the HSA to grow or use them to pay for qualified medical expenses under your new policy.

▶︎ Your employer can contribute to your HSA (which counts against your contribution limit — but hey … free money!).

▶︎ If you don’t use the funds in your HSA before the end of the year, the funds roll over to the next year. There’s no “use-it-or-lose-it” risk.

▶︎ You can do a one-time tax-and-penalty-free funding rollover from your IRA into your HSA.

▶︎ If you don’t want to pay for qualified health care expenses from your HSA right away, you can employ “shoeboxing.” This means setting medical receipts aside. You can use these receipts to claim tax-free withdrawals at a later time. This can even be years in the future, if you’d like.

▶︎ Once you’re Medicare-eligible, you can no longer contribute to an HSA. However, you can then use funds in your HSA for any reason. The distributions, while no longer subject to tax penalty, would be taxed as ordinary income like a traditional IRA.

Knowing these benefits, it’s clear why HSAs are growing in popularity. Not only can an HSA be a savvy way to save for healthcare but it can also be a strong retirement-savings option. And with retirement and healthcare being two major life expenses, employing an HSA can also bolster your financial plan, protecting you from major out-of-pocket expenses.

Is an HSA Right for You?

As great as I think HSAs are, they’re not for everyone. If you’re considering an HSA, the first question you can ask yourself is, “Would a high-deductible health care plan be the right insurance option for my needs?” Then, consider some of the potential downsides to HSAs:

▶︎ If you withdraw money from your HSA for a non-qualified expense, the penalty is a stiff 20%.

▶︎ You must be able to substantiate qualified medical expenses to prove that you used your HSA withdrawals properly.

▶︎ Some HSAs charge account fees or transaction fees, which can eat away at your savings.

▶︎ If you aren’t already contributing enough to receive the full employer match in your 401(k) or similar retirement account, funding an HSA might not be the best way to meet your more-pressing financial goals.

With the right balance of insurance coverage and savings goals, an HSA could be an effective tool in your financial toolbox. It’s worth it to consider the options. And don’t skip over HSA-eligible high-deductible health insurance simply because of the high deductible part.

You may even find that you’ll fall in love with an HSA, too.

Not a client yet? See if our ensemble approach is right for you.