Money’s perceived value is the foundation for other financial areas of life. Money is exchanged in these types of transactions because both the seller and the buyer agree that a certain amount of money represents the appropriate value for the transaction to take place. For example:

— A home’s buyer and seller agree upon the home’s value.

— You agree with the cost of the toothpaste you buy at the grocery store.

— You agree to the cost you pay for a cup of lemonade at a child’s lemonade stand.

— And an agreed-upon cost of a company’s stock price on the stock exchange exists between a buyer and seller.

Whenever trust becomes jeopardized in the financial markets, powerful forces hope to regain that trust to prevent chaos. If people begin to not trust banks, stock markets, and other financial institutions, people will participate in bank runs and not allow money to flow within the economy.

With the most-recent GameStop financial mania storyline, a disconnect between the stock value and the stock price occurred. This has the chance to erode people’s trust in the financial markets. Sadly, this isn’t the first example of fraud and manipulation. But fortunately, there’s a pattern for how to restore trust after these occurrences.

Financial Fraud and Manipulation

We don’t know what the aftermath of this GameStop mania will be. Yet, there is a history of financial fraudsters running amok, thus causing some doubt in the value of the financial markets. When this occurs, regulators typically find a way to hopefully prevent similar activities.

Before the stock market was such a driving force in people’s everyday financial lives, documented financial fraud typically involved quarrels among wealthy families.

Robber Baron Vanderbilt Gets Swindled: Between 1866 and 1868, Daniel Drew defrauded railroad baron Cornelius Vanderbilt who owned stock in the Erie Railway Company. Drew, a member of the board of directors of the Erie Railway Company, did it by “watering down” the company’s stock by illegally issuing more shares. Thus, he diluted Vanderbilt’s overall ownership in the Erie Railway Company. This dispute was resolved through litigation between the parties, and Drew died in prison for embezzlement and fraud.

This spat between individuals saw justice carried out through litigation, but the financial markets became bigger when investors started putting their life savings into companies. Whenever dishonest salespeople defrauding investors tested trust in these large-scale investments, state politicians passed state laws that required salespeople to register with the state and agree to some oversight. This was an attempt to make individual investors feel more comfortable and trust in the financial securities industry, but it was limited to a state level until 1933.

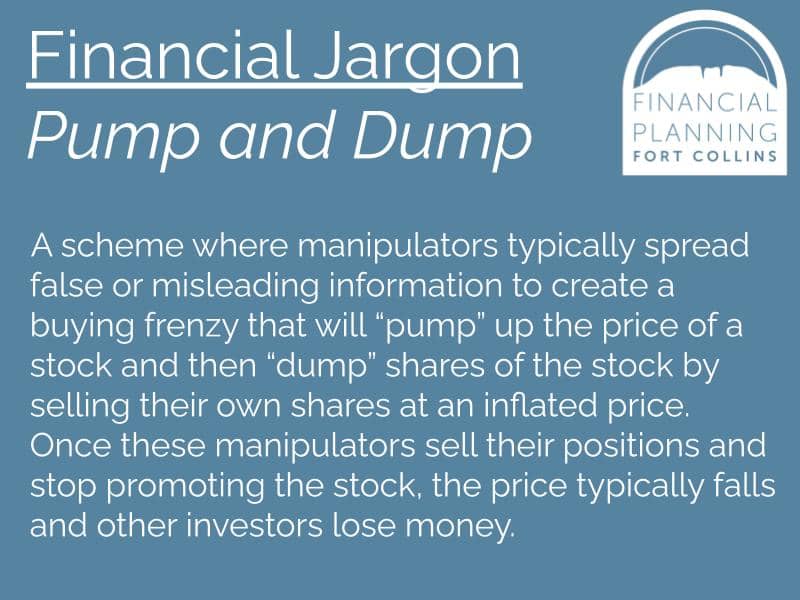

Stock Pools Pumped and Dumped: The appetite for investing increased after World War I. The financial markets now involved many Americans’ savings instead of being a financial playground for the wealthy. Some fraudsters participated in “pump and dump” schemes, which manipulated the stock price of large companies represented on the stock exchanges.

After the stock market crash of 1929, the government needed to restore trust in financial markets so investors would again feel secure, knowing that their money wasn’t vulnerable to large-scale fraudsters and manipulations. The government stepped in and passed The Securities Act of 1933. The goal of this act was to ensure more transparency in financial statements so investors could become informed about public companies’ financials as well as to create laws to deter fraudsters and manipulators who could erode trust in the financial markets.

Since the Securities and Exchange Commission (SEC) was formed a year later to enforce the 1933 act, a pattern of whack-a-mole occurs. New fraudsters’ schemes surface — and the government creates new regulations to prevent copycats.

For example, the US government and the SEC passed the Sarbanes-Oxley Act of 2002 in response to Enron’s and WorldCom’s manipulative accounting practices. The SEC created regulations to streamline public accounting methods to hopefully prevent similar fraudsters from eroding the public’s trust when investing in large companies.

What You Can Do

We aren’t going to encourage you to just sing George Michael’s song, “Faith.” (you’re welcome for the earworm) and have blind faith toward investing. Here are three themes to consider whenever you feel yourself losing trust in the financial markets.

1. Understand Your Risk Levels and Know the Difference.

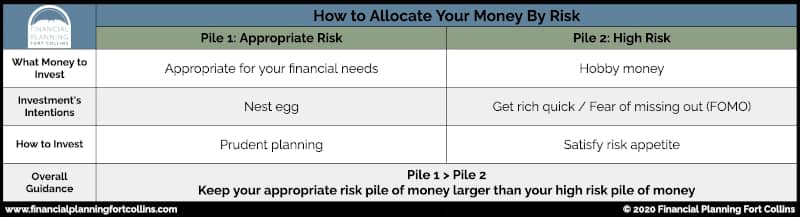

We recommend that you avoid speculation when it comes to investing money relevant to your financial plan. For your life savings and the money you’ll depend on to reach your financial goals, we recommend prudent investing strategies based on your risk tolerance, time horizon, tax efficiencies, and the factors you can control with your investments — like your fees and expenses.

We’ve heard of people cashing out their 401(k)s to participate in financial manias like GameStop, and this is when people get into financial trouble. This exposes your financial life to risky and speculative bets.

Overall, having a diversified portfolio of stocks is aggressive but not nearly as risky as individual stock-picking with speculative strategies. If you want to participate in speculative trading, I encourage you to separate that money as your “hobby money” instead of your life savings.

2. Invest in What You Understand.

Don’t get caught up in crazes or follow the herd in trends you don’t fully understand. During the GameStop whirlwind, some investors bought shares of GameStop after the prices were inflated. Some investors felt they were missing out on this hype and wanted to get in before it was too late. Yet the people who promoted the stock prices were the ones who sold at a profit, thus getting out of those positions before the prices were likely to return to an appropriate valuation.

This is an example of a pump and dump scheme, and we’re already seeing headlines of investors becoming multi-millionaires after selling their positions. Where’s the storyline of the person who bought the shares from these GameStop manipulators — and how they’re “holding the bag” as GameStop prices will now likely return to their previous values?

Warren Buffet has many wise sayings, and one commonly attributed to him is:

Pro Tip: A storyline that’s also missing is how the IRS incentivizes investors to hold onto positions for at least a year instead of buying-selling throughout the year in a speculative manner. You’re likely to pay more in taxes for short-term capital gains than long-term capital gains.

3. Trust Your Financial Planning.

You’re in control of your personal financial life. You can’t control the financial markets, but you can believe in the institutions that try to ensure trust in the financial markets. Fraudsters and manipulators will always surface in humankind, yet you invested your money because you believed that it would become more valuable over time. Our investment philosophy is inspired by Warren Buffet with a sense of optimism that companies will continue to become more valuable over time by selling products and services to more consumers.

Ugly moments of fraud are a stain on the financial markets, but they don’t derail our trust in your financial plan. When things change, we update the plans. That’s why we remind clients that the word “plan” should be viewed as a verb and not as a noun.

Right now, this GameStop mania is annoying and some people will lose a lot of money. Yet there are thousands of other companies listed on the financial markets. That’s why we encourage our clients to trust the financial plans we made together with diversified portfolios based on their financial goals. Overall, control what you can control and you may need to sometimes sing the song lyric, “You gotta have faith.”