Want to make sure you are taking advantage of all the benefits your employer has to offer? The concept of an Employee Stock Purchase Plan (ESPP) may have come up during salary negotiations, in your offer of employment letter, in chats with your colleagues, or listed in your employee benefits package.

If your company offers an ESPP, you are at a distinct advantage: You can work directly with your employer to purchase your company’s stock on a set schedule for a predetermined discounted price. Purchasing shares through an ESPP can be one of the simplest and most cost-effective ways to invest in your company’s equity.

For those who like bargain hunting, keep reading!

Types of ESPPs

Qualified ESPPs — Also known as a Section 423 plan, this is the most common type of ESPP. If your employer offers a qualified ESPP, they give you the tax-advantaged opportunity to purchase stock at a discount. Tax-qualified ESPPs only permit the purchase of $25,000 of plan stock during a calendar year.

Nonqualified ESPPs — This type of ESPP allows you to purchase discounted stock like a qualified ESPP but without the tax advantages.

Key ESPP Definitions

Before exploring the wonderful world of ESPPs, it’s helpful to know a few key terms:

Enrollment Period — Typically offered twice a year, this is when you’re able to enroll in an ESPP. During this period, you will decide how much of your paycheck you would like to contribute. You’ll want to make sure you have an employer benefits guide to know when the enrollment period starts.

Offering/Grant Date — This is the date the plan officially becomes available to participants.

Purchase Period — After enrolling in the ESPP, the purchase period is the time during which after-tax salary contributions are deducted from your paycheck to purchase discounted shares of your employer’s stock. The amount of time your purchase period is open may vary depending on your employer.

Purchase Date — The purchase date is when your deducted contributions are used to buy your company’s stock. The purchase dates are usually scheduled in six-month intervals.

ESPP Discounts

Through an ESPP, you can purchase shares of your company’s stock at a significant discount. Often, this “sale price” is between 5-15% below market value. For example, if your company’s stock is trading at $20, an ESPP could allow you to purchase the shares at $17-$19.

But what if your company’s market value increases dramatically — say 15-20% — over the purchase period? Some businesses deal with this problem through a “lookback feature.”

If your company offers an ESPP with a lookback feature, you can purchase the stock at the discounted price at the start of the purchase period or the end of the purchase period, whichever is lower. Let’s say your plan offers a 10% discount and the stock price at the start of the offering is $15 a share, and it rises to $18 per share on the date you make your purchase. With the lookback, the 10% discount comes off of the lookback price of $15. The $18 market price on the date of purchase is irrelevant, so you are buying the stock for $13.50, or 10% off of $15.

If the purchase date price ends up being lower, you simply apply the discount to that price.

ESPPs and Taxes

If you own qualified ESPPs, check out the differences between a qualifying disposition and a disqualifying disposition.

Qualified ESPPs — If you’re enrolled in a tax-advantaged ESPP, there’s no tax on the shares at the time of purchase. There is also no Social Security, Medicare, or other tax withholding. Considering that you received value in the form of a discounted purchase price, this is a fantastic advantage!

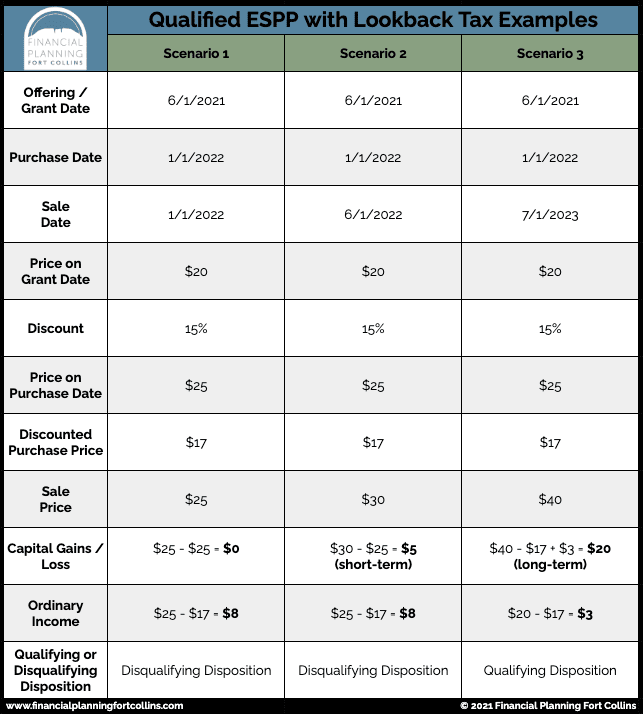

When you sell the shares, a portion of the sale may be ordinary income and another portion a capital gain. Both amounts depend on how long it’s been since the shares were offered — aka granted — to you and how long it’s been since you purchased them.

Qualifying Disposition — A position becomes qualified two years after the offering/grant date and one year from the purchase date. When this happens, you can benefit from the tax advantages a qualified ESPP offers. You will likely still recognize ordinary income in addition to your capital gain. However, in almost all cases, the amount of ordinary income recognized is the difference between the stock price on the offering date and the discounted price on that same date. The capital gain you will recognize is the difference between the price you sell the shares for and the price you purchased them for plus the ordinary income you recognized.

Disqualifying Disposition — A position is disqualified when you don’t meet the holding period qualifications for a “qualifying disposition.” This means that the position loses its tax-advantaged status. As a result, you will recognize ordinary income on the difference between the stock price on the date you purchased the ESPP shares and the price you actually paid. You will then recognize a capital gain on the price you sell the shares for less the price on the date of purchase. Depending on the holding period, it is still possible for shares sold in a disqualifying disposition to receive the more favorable rates of long-term capital gain tax treatment.

To better understand how your shares will be taxed when sold, check out the chart below. Assume the following are examples from a Section 423 qualified plan with a lookback.

Nonqualified ESPPs

A nonqualified ESPP is often structured like a qualified ESPP, but there is a critical difference when it comes to taxation. Specifically, when you purchase shares through a non-qualified ESPP, the discount you receive is taxable as wages — including FICA taxes — on the date of the purchase.

Your purchase starts your holding period and, if there is a gain or a loss when the shares are sold, it will be taxed as a long- or short-term capital gain or loss. The gain or loss is measured by subtracting the full value of the stock on the purchase date from the price you sell it for.

Risks of Enrolling In your Employer’s ESPP

To every investment, there is a risk. An ESPP is no different. There is always the chance that your employer’s stock prices drop below your purchase price. This risk is relevant if your employer’s plan doesn’t have a lookback feature and is compounded if you are too heavily invested or highly leveraged in your company’s stock.

It’s always prudent to have a diversified portfolio and not lean on one investment.

How Much Should I Contribute to My ESPP?

When deciding how much to contribute to your ESPP, you should consider the following list to help inform your decision. It can also help you determine whether you have appropriate funds available to contribute.

You’ll notice that our savings philosophy encourages you to address the foundational part of your Personal Savings Hierarchy first to then feel confident to use your ESPP as a savings vehicle.

First: Get Your Personal Financial House in Order

1. Is your emergency account properly funded?

It’s important to set aside three to six months of expenses in case of an emergency.

2. Do you have any high-interest debt?

If the answer is yes, you should be putting money toward paying the debt off.

3. Are you contributing to a 401(k)? If so does your employer offer a match?

Saving for your retirement should take top priority. Contributing to your 401(k) is one of the best ways to save for your future. If your employer offers a match, make sure that you are contributing enough to your plan to receive the full match.

4. Are you able to contribute to a health savings account (HSA)?

HSAs are amazing triple-tax-advantaged vehicles that do not tax your contributions or distributions as long as you put the distributions toward health expenses. If you are eligible, you should contribute to an HSA.

5. Are you planning on making a large purchase in the next 12 months?

If you plan to buy a house or vehicle, or you plan to make any other large purchases soon, it’s wise to set aside some cash that is not invested. That way, when it’s time to make that purchase, you will have the funds available.

Then: Bargain Hunt With Your ESPP

Your company’s contribution limit: The IRS has limited the amount that you can contribute to a Section 423 qualified ESPP. In 2021, the contribution limit is $25,000. Your employer can also place further restrictions on how much you can contribute to your ESPP. Be sure to check to see if your employer has a contribution limit.

▶︎ Pro-tip: Plans with lookback provisions afford you the opportunity to receive a relatively low-risk investment and quick ROI on your contribution if you plan to and are able to sell immediately after the purchase date. Your discount will be taxed as ordinary income, but don’t have to let the tax tail wag the income dog if this situation fits your financial plan.

When Should I Sell My ESPP Shares?

When deciding when to sell your position, it is important to remember that, to partake in the tax advantages of an ESPP, you will need to hold the shares for a certain period of time before selling them (see above).

Ideally, if your company is doing well and you anticipate making a profit when you sell your shares, it is beneficial to wait until the shares become qualified to reap the tax benefits. Thus, you can diversify your financial success away from relying on your company’s financial success. You can do this by taking the proceeds from your ESPP shares to then reinvest in more diversified portfolios.

As always, investing in an ESPP can be a gamble. There are no guaranteed outcomes, and you should be aware of being too heavily invested in your company — as well as the risk that comes with that.

What Happens if I Leave My Company During the Purchase Period?

You may be wondering what would happen if you were to leave your employer while enrolled in their ESPP. Once you leave your company, you are no longer able to contribute to your ESPP. Upon leaving, you will receive a lump-sum payment of your accumulated contributions. Leaving your job will not affect the shares you have already purchased, so you can take those shares with you.

If your employer offers an ESPP, you have several things to consider. Most important, it must make sense for your personal financial plan and align with your goals. We can help guide you through this process to assess if the ESPP your employer offers fits within your broader financial plan. Under the right circumstances, an ESPP could be a great opportunity to invest in your company and potentially reap meaningful tax benefits.

Now, when you’re at the water cooler talking about your company’s ESPPs, you can feel more confident with this jargon-filled employee benefit!