Happy 2024! After a few turbulent years, I hope your New Year is off to a fantastic start and that 2024 will be a prosperous one for you.

Finding yourself with a little more prosperity this year, or want to set your future self up for success? It’s time to take advantage of additional capacity for tax-advantaged savings!

If you’re planning your contributions for this year, read on to learn about 2024 contribution limit increases. Plus, check out some other tax and financial planning opportunities you may want to consider this year.

Increased — and Unchanged — Contribution Limits

Health Savings Accounts (HSAs)

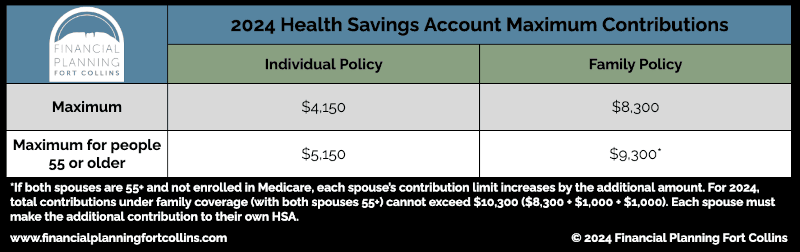

2024 brings with it one positive contribution-specific change from the IRS: Increased health savings account (HSA) limits! The catch-up contribution for those age 55 or older — including those who are turning age 55 this year — is still $1,000. But the limit for individuals is up by a whopping $300! For families, that amount is up by $550 over 2023 limits. You can see the details in this table:

To break up your contributions into your monthly cash flow, if you’re under age 55 and want to contribute the maximum to your HSA this year, you can:

- Contribute $345.83 per month to your individual HSA; or

- Contribute $691.67 per month to your family HSA.

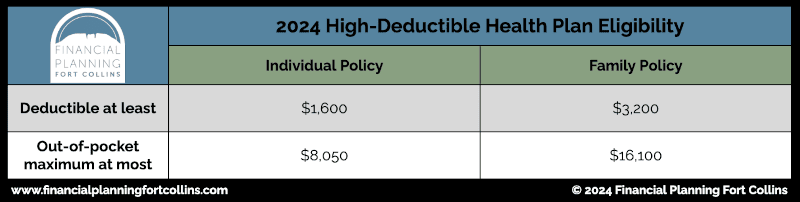

Not sure if you can contribute to an HSA in 2024? Both the minimum deductible amount and the maximum out-of-pocket limit for qualifying high-deductible health plans (HDHPs) have changed this year. Whether you selected a new plan or your plan has stayed the same but its limits have changed, be sure to check your eligibility.

And if you’re not able to contribute this year, don’t forget that you have until April 15 to add to your HSA for the 2023 tax year. You can find information HSA benefits in Jason’s Financial Favorites: Health Savings Accounts (HSAs).

Retirement Savings

What about your 401(k), 403(b), or 457(b)? Employer-sponsored catch-up contribution limits for those 50-plus remain the same at $1,000 in 2024. The same is true for the individual retirement arrangement (IRA) catch-up contribution limit, which also remains at $1,000. However, both employer-sponsored retirement plan and IRA contribution limits are up for 2024! Here’s how those numbers break down by month for those under age 50 who are looking to max out both plans:

• With the maximum contribution increased to $23,000, those with 401(k), 403(b), or 457(b) accounts can contribute $1,916.67 per month or $884.62 per bi-weekly paycheck.

• For those with traditional or Roth IRA accounts, the maximum is $7,000 for 2024. This means a $583.33 contribution each month will get you to the max.

As you plan your contributions this year, you might be wondering in which order you might want to make your contributions For some general guidance, head to Jason’s blog, Choose Your Own Contribution with Higher Retirement Plan Limits. We haven’t updated the contribution limits here, but the general order of contributions remains the same. And while the window of opportunity for contributing to an employer-sponsored retirement plan for the 2023 tax year has closed, a reminder that you have until April 15 to contribute to your HSA and your traditional, Roth, or backdoor Roth IRA for 2023.

Speaking of retirement accounts, required minimum distribution (RMD) rules changed, starting with the 2023 tax year. The penalty for not taking your required minimum distribution this year remains the same as last: You pay an excise tax equal to what a quarter of what your RMD should have been if you don’t take it. If you’re subject to RMDs starting in 2023, you can learn more on the IRS website.

Tax Law Changes

Tax day this year is scheduled for the familiar April 15. You might not be thinking about your 2024 taxes when you haven’t filed your 2023 tax return yet, so I’ll stick to some high points that you may want to have on your radar for this year.

Changes for 2024 include tax bracket adjustments as well as a higher standard deduction. Tax rates for each bracket haven’t changed, but the taxable income limit for each bracket increased slightly for 2024. With tax season just around the corner, you can gain a better understanding of how the bracket changes could affect you when you file your 2023 taxes and work on your 2024 tax projection. As for the standard deduction, it’s up by $750 for single filers and increased by double that amount for married taxpayers filing jointly:

• The standard deduction for single filers for the 2024 tax year will be $14,600.

• The standard deduction for married taxpayers filing jointly is $29,200.

Other tax changes for 2024 include those to taxable income limits for long-term capital gains rates, alternative minimum tax (AMT) exemption levels, deductible IRA and Roth IRA phaseout limits, and more. These changes aren’t as widely applicable, but that doesn’t mean they couldn’t apply to you. If you have questions on how these changes could affect your tax situation, just let us know.

Social Security COLA

One more positive change for 2024? A 3.2% cost of living adjustment (COLA) increase in Social Security payments. If you’re new to Social Security, you can expect this increase every year. It’s tied to annual increases in the Consumer Price Index (CPI), and you can learn more about the COLA on the Social Security website.

How can we help you make the most of these important changes — and changes in your own life — for 2024? Let us know! Reach out or schedule your next consultation to see how we can help you make positive changes this year!